The Future of Payments Is Unattended

)

As the retail and mobility sectors continue to evolve, so too does the way we pay. Matt Oldham, Chief Strategy Officer at Attenda, explores a growing trend: the shift toward unattended payments. With consumers, especially younger ones, prioritising speed, convenience and frictionless experiences, unattended solutions are no longer a niche; they’re the future. From insights into consumer behaviour to examples from leading brands, Matt outlines why this shift matters, and how retailers can embrace it to unlock new opportunities.

This month we have guest contributor Matt Oldham who is the Chief Strategy Officer for Attenda, the Mobility Payments specialists. Attenda work with fuel and forecourt businesses, EV (electric vehicle) and other transportation operators, creating attended and unattended payment solutions for people on the move.

The future of payments is increasingly unattended – and for good reason. Today’s consumers, especially younger generations, favour speed, convenience and frictionless experiences. Think about how teenagers communicate – via apps, in-games messaging, short forms chat – without ever speaking on the phone. Payments are heading in the same direction: self-serve, contactless and entirely automated.

Unattended payments – transactions that happen without direct human involvement – are already a $100 billion global market, growing to $130 billion by 2030. Europe accounts for about a quarter of this, with the UK representing roughly10-15%. This shift is driven by consumer preferences.

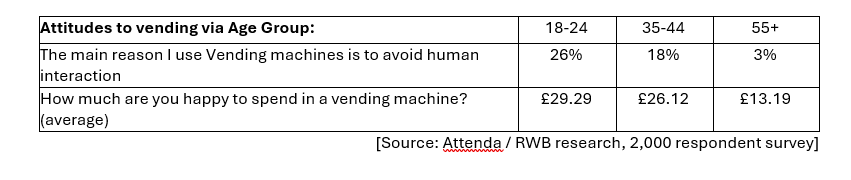

Our research reveals that consumers under 25 are significantly more likely to choose unattended POS options. As shown in the extract below, younger shoppers value anonymity much more than older demographics. Additionally, younger consumers demonstrate greater comfort with higher value vending transactions.

The survey shows why unattended makes sense. 37.5% of respondents use vending options when shops or manned options are unavailable and over 30% to avoid standing in queues, making them ideal for quick, no-wait purchases.

Retailers recognise the value too. P&O Ferries, an Attenda client, has recently implemented unattended retail solutions across its ships, enabling 24/7 shopping – boosting sales while reducing staffing needs. The range of what is sold via machines is evolving too. Take Nosh for example, providing hot meals in NHS canteens. Across Europe, unattended local grocery stores are popping up, even offering fresh eggs.

We are seeing our clients in the fuel and forecourt sector broaden retail opportunities with high ticket external vending such as laundry services. Unattended payments allow retailers to monetise more of their physical estate, extend hours and provide speed and convenience to customers.

Perhaps the biggest catalyst for the continuing growth, and one that will cut through demographic barriers, is the rise of electric vehicles (EVs). By 2035, estimates suggest that 60-80% of UK drivers will own an EV. The payment experience will be unattended. Today this is a challenge as the “mobility payment” experience if far from smooth. Clunky apps, multiple platforms and pre-authorisation frustrations are common. Yet, the payments industry has a history of collaboration – think ATMs and Link – so there’s optimism that a seamless, universal EV solution is achievable.

Attenda recently hosted a cross-sector “Think-in”, bringing together car manufacturers, payment providers, CPOs and Mobility tech specialists*. The goal: reimagine mobility payments to be frictionless and invisible. The engagement was promising with stakeholders committed to creating a unified, seamless customer experience.

As unattended payments become more prevalent, industry collaboration is vital. Consumers deserve the same trust, security and simplicity as they have come to expect from other payment methods. Leading payment providers who work with merchants to embrace this shift will be at the forefront of delivering greater choice and seamless, innovative experiences for the next generation of consumers.

You can join the LinkedIn “Think-in Community” conversation here - THINK-IN Community | Groups | LinkedIn