Instant Payments Strategy: 5 Pro Tips to Avoid Common Pain Points

)

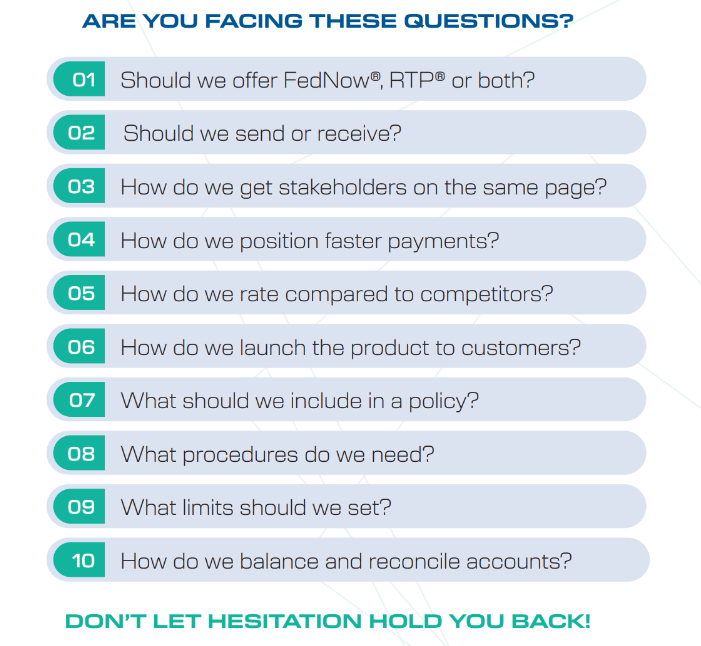

The number of U.S. financial institutions participating in the FedNow® or RTP® instant payments networks has skyrocketed. However, as the financial industry continues to shift toward faster and more efficient payment technologies, implementing instant payments can present significant challenges. From cross-functional collaboration to risk management, financial institutions often find themselves navigating a complex and evolving landscape.

Here are common pain points EPCOR, a U.S. payments association, has uncovered while helping financial institutions implement instant payments and tips to avoid them.

1. Lack of Cross-Functional Collaboration

A common struggle is the lack of coordinated efforts across departments. Nicole Payne highlights that instant payments require unprecedented levels of teamwork. “Even more areas of the financial institution need to be involved in planning efforts than for your typical new product launch,” Payne explains. With the immediate settlement and availability of instant payments, departments must align their efforts to ensure seamless implementation.

Pro Tip: Create a cross-functional team comprised of stakeholders from all areas of your institution that will meet regularly throughout your planning and implementation process. Structured sessions encourage departments to "speak the same language and row in the same direction,” facilitating smoother launches.

2. Underestimating the Complexity of Implementation

Although instant payments may seem straightforward technically, the operational nuances pose significant challenges. Payne points out, “Even though the actual ‘flipping the switch’ to instant payments may be easy for your core provider, there are so many moving parts to consider before taking the service to market.”

This complexity often leads institutions to overlook critical factors, such as compliance, risk and finance, which must be addressed early in the planning process.

Pro Tip: Create a laundry list of considerations and tasks, soliciting feedback from your cross-functional team. Then, refine and build out your list, taking timeframes, dependencies and ownership into consideration. Breaking down complex tasks into manageable steps helps teams identify and mitigate potential roadblocks.

3. Navigating an Array of Options

Institutions face a vast ecosystem of technology, funding and risk management partners when integrating instant payments. Payne notes that “no two paths to instant payments will look the same,” emphasizing the need for a tailored approach. The service helps financial institutions evaluate their options and develop a phased implementation plan suited to their unique needs.

Pro Tip: Think outside the box. Don’t be afraid to ask questions, make requests and really dig into the details with third-party service providers. It’s likely that an out-of-the-box solution won’t be an exact fit for your institution, but it’s equally as likely that a workaround is possible.

4. Identifying Hidden Risks

Institutions also often feel rushed to implement solutions to remain competitive, inadvertently sidelining comprehensive risk assessments. Many also rely on third-party service provider partners for implementation, assuming they have addressed all potential risks, which is not always the case.

Pro Tip: With instant payments, institutions may encounter risks that traditional payment systems don’t present. Be sure to account for faster fraud cycles and greater exposure to operational errors due to immediate settlement. Conduct a thorough risk assessment prior to implementation.

5. Stress Testing Systems and Processes

It’s hard to think of every possible scenario that might come through the door, how departments will work together or what might happen when you are under pressure. After all, you haven’t implemented instant payments yet! Without proper planning, institutions often overlook bottlenecks, compliance gaps and other challenges.

Pro Tip: Conduct a stress test that simulates real-world scenarios, highlighting the ripple effects of instant payments across departments. This exercise often reveals gaps in processes and policies, prompting actionable insights. Take notes and schedule further discussion as needed.

Preparing for the Future of Payments

As the financial industry increasingly adopts instant payments, institutions must prepare for growing transaction volumes and future complexities. Payne emphasizes the importance of readiness, stating, “We want our clients to be well-prepared for the challenges that come next.”

How EPCOR’s Enablement Service Eases the Transition

By addressing collaboration gaps, simplifying implementation and equipping teams with practical tools, EPCOR’s Instant Payments Enablement Service positions financial institutions for success in the fast-evolving real-time payments landscape.

- Guided Implementation Plans: A comprehensive roadmap to help institutions manage the complexities of instant payments.

- Collaboration Exercises: Activities like the stress test and internal controls review foster teamwork and uncover blind spots.

- Tailored Advice: Solutions customized to fit the unique needs of each institution.

Putting Your Best Foot Forward

Given the complexities of the instant payments landscape, engaging a consultant to guide your implementation process can streamline your path to market, reducing stress and uncertainties. However, if consulting services are not a feasible option, numerous resources are available to support your efforts. We encourage you to connect with your payments association to explore the tools and guidance they offer to help you successfully navigate the transition to instant payments.

About EPCOR® – Your Electronic Payments Core of Knowledge

EPCOR is a not-for-profit payments association that provides payments expertise through education, advice and member representation. EPCOR assists banks, credit unions, thrifts and affiliated organizations in maintaining compliance, reducing risk and enhancing the overall operational efficiency of the payments systems. Through our affiliation with industry partners and other associations, EPCOR fosters and promotes improvement of the payments systems which are in the best interest of our members. For more information on EPCOR, visit www.epcor.org.

Nicole Payne | VP Advisory Services | EPCOR